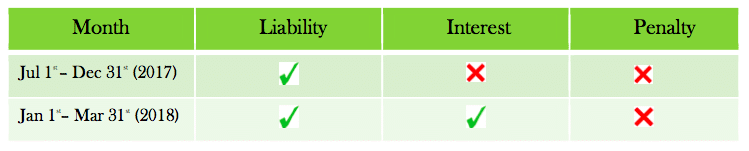

Barring any extension, the Voluntary Asset and Income Declaration Scheme (VAIDS) will come to an end on March 31, 2018.

VAIDS, an initiative by the Federal Government to allow Nigerians regularise their tax status, started back in July 2017. It is believed that the scheme will give the government access to a sustainable revenue source while also building a credible tax database.

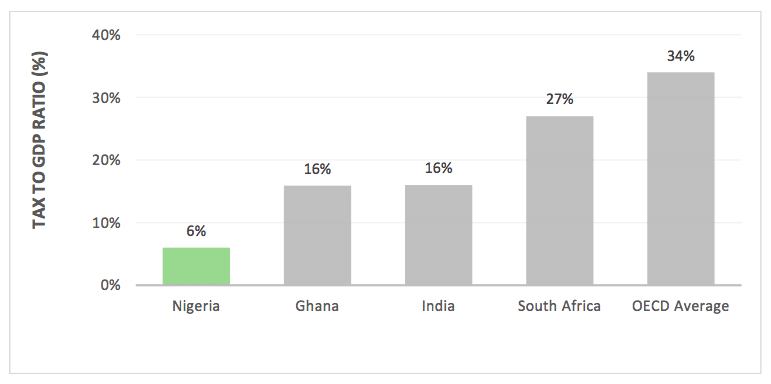

Nigeria’s tax-to-GDP ratio is just 6%, which is relatively low when compared to other African countries. The taxpayers' population is low as well -- just 14 million in a country of an estimated 69.9 million economically active people as at May 2017.

One of the merits of utilising VAIDS is the qualification to have tax-related offences forgiven. Taxpayers that seize the VAIDS opportunity can also enter into an arrangement with relevant tax authorities to enable instalment payment of outstanding tax liabilities over a period of time. All these are on the condition that taxpayers declare assets fully and honestly.

FIRS had in 2016 granted waivers of penalties and interest on tax liabilities between October 5, 2016 to November 24th, 2016 for corporate bodies.

Why should startups care about VAIDS?

According to pioneering tax journalist Muyiwa Matuluko Sr., startups cannot afford not to pay tax, as the law stipulates that businesses must file tax returns not later than 18 months after commencement of business.

For businesses that have not been generating revenue, the tax authority has to be notified in form of a statement of affairs after which a tax clearance certificate will be issued to the business.

Muyiwa believes that the entire tax registration process has been made seamless enough that no one can think of an excuse for not declaring.

At the end of the amnesty window, the FIRS will commence criminal prosecution of tax evaders who do not make use of the opportunity. Do note that interest and penalties on taxes due are 21% and 10% respectively.

Be the smartest in the room

Give it a try, you can unsubscribe anytime. Privacy Policy.

Speaking in Lagos recently, the Federal Inland Revenue Service (FIRS) Chairman, Tunde Fowler, affirmed that there will be sanctions for anyone that fails to ride on VAIDS, and that the tax authority has made provisions for funding of legal actions in the year’s budget.

By the way, there was a promo campaign for the scheme with the promise of ₦100,000 to 5 lucky winners, in a bid to encourage compliance.

https://twitter.com/PhotoBarNg/status/973189662037692421

It is not clear how such a campaign will tackle some of the obvious reasons why startups do not pay tax, part of which are ignorance and associated costs.

But in the words of the Principal Consultant of Masal Consultants, Munachi Alfa, startups need to know that tax is unavoidable, especially for those looking forward to scaling or getting investment.

For example, the Tax Clearance Certificate (TCC), issued by the FIRS, is one of the documents require when raising international investment. With many Nigerian startups already getting international attention and funding, they need not be forced to ride on this scheme.

Besides, the taxman knows you and the Bank Verification Number (BVN) makes it easier for him. With BVN, relevant government agencies and tax authorities know how many bank accounts an individual or corporate body owns.

With the voluntary declaration, corporate bodies and individuals will be free from tax audits or investigation as the case may be.

How to take advantage of VAIDS

The VAIDS amnesty scheme is coming to an end on March 31, 2018.

It's not too late to sign up and complete the entire process online here. However, in our attempt to use the portal, we discovered that the experience is not quite seamless.

As an alternative, you can visit the VAIDS desk at any of the tax offices across the federation for assistance. If you prefer, can also opt for self-assessment of your tax liability or be assisted by a tax authority agent. There are professional tax consultants that can help with declaration.

For more information, visit the VAIDS FAQ page.