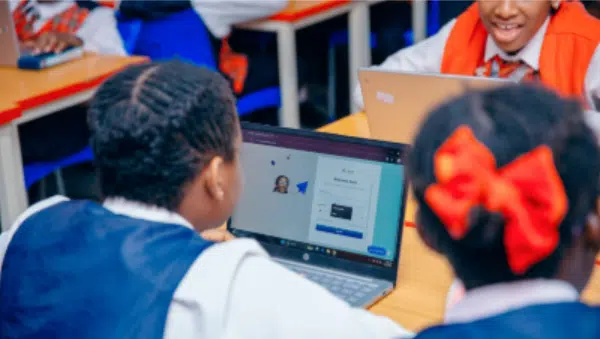

Transforming African Education: Bildup AI Launches “AI in Every Classroom” Initiative

A New Era for African Education: Bildup AI Ushers in…

Top Stories

Operating behind the scenes, Kuunda enables banks and enterprises to lend at scale. With new funding, it’s moving into savings, launching in new markets, and building a financial literacy bot.

On today’s episode of Techpoint Digest, we discuss Wakanow’s new acquisition, how CBN’s new rules are changing the POS business.

On this edition of Techpoint Digest, we discuss COMESA’s inquiry into MaxAB-Wasoko merger, healthcare access, and South Africa’s decision on Starlink.

With its new ZOI-embed tool, Nigerian health-tech startup WellaHealth wants to make buying health insurance, booking diagnoses, and getting prescriptions possible through any platform.

Brand Press:

Thursday, October 16

Forget fake alerts and delayed bank transfers. ZinariPay’s crypto marketplace…

Rana Energy, an AI-powered Clean Energy-as-a-Service ecosystem, announced the successful…

Zeustek Global’s AI platform lets Nigerian SMEs build websites using…

Sony Middle East and Africa has announced the expansion of…

MTN Nigeria team joined B4B Partners in supporting startup growth…

The Africa Deep Tech Challenge (ADTC) 2025 has officially concluded,…

Minister of Communications and Digital Economy, Dr Bosun Tijani; the…

Vendcliq helps beverage vendors restock smarter, track insights, and boost…

Gemini Group’s Bulk SMS gateway guarantees a 94% delivery rate,…

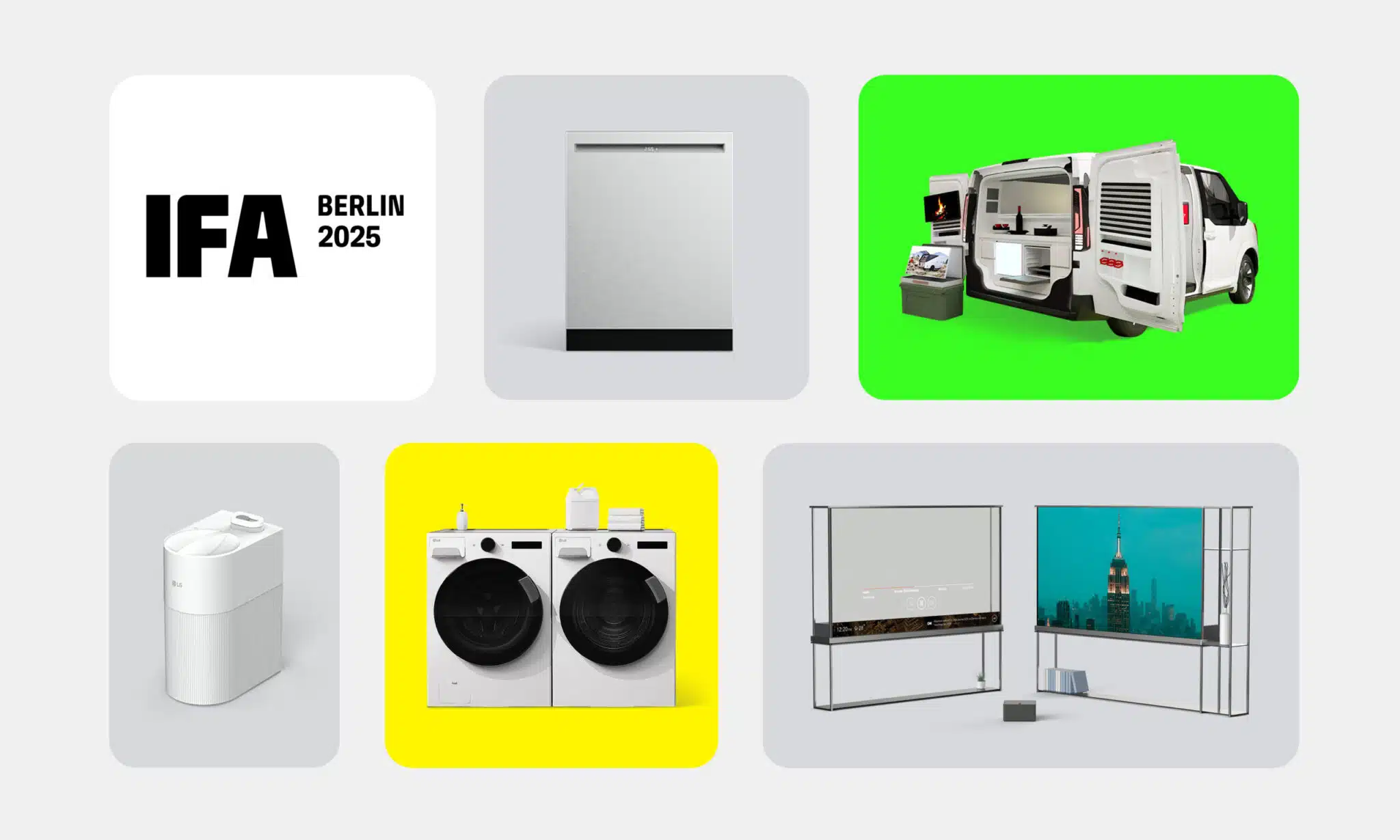

Company Secures Prestigious “Best of IFA” Recognition and Multiple Category…

You can post on Techpoint Africa too!

Post hereForget fake alerts and delayed bank transfers. ZinariPay’s crypto marketplace…

Rana Energy, an AI-powered Clean Energy-as-a-Service ecosystem, announced the successful…

Zeustek Global’s AI platform lets Nigerian SMEs build websites using…

Sony Middle East and Africa has announced the expansion of…

MTN Nigeria team joined B4B Partners in supporting startup growth…

The Africa Deep Tech Challenge (ADTC) 2025 has officially concluded,…

Minister of Communications and Digital Economy, Dr Bosun Tijani; the…

Vendcliq helps beverage vendors restock smarter, track insights, and boost…

Gemini Group’s Bulk SMS gateway guarantees a 94% delivery rate,…

Company Secures Prestigious “Best of IFA” Recognition and Multiple Category…

You can post on Techpoint Africa too!

Post hereOther highlights

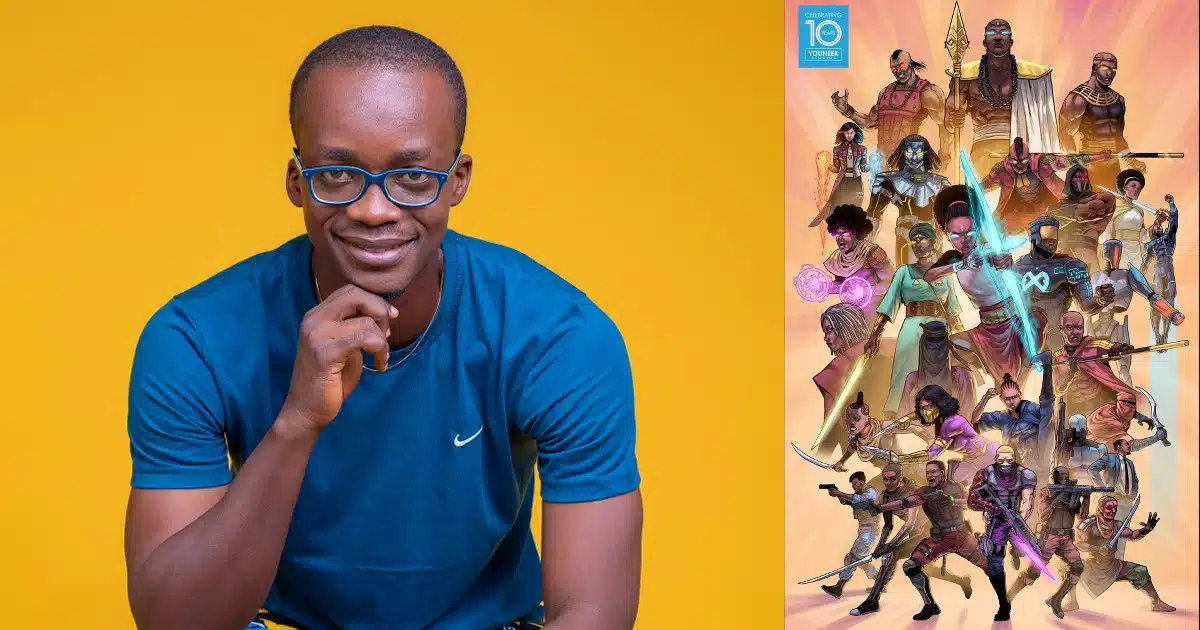

Today on Techpoint Digest, we discuss Absa’s plot to leap into the MVNO, the Nigerian creator whose digital novels are now on Cartoon Network and HBO, and Eastern and Southern Africa’s digital retail payment platform.

In this edition of After Hours, Sunkanmi Akinboye shares how he went from quitting his 9-5 job at an accounting firm to featuring his digital novel series on Cartoon Network and HBO Max.

Businessfront Over 50 celebrates Nigerian companies that have lasted 50+ years — honouring resilience, legacy, and impact that outlives generations.

On Techpoint Digest, we discuss Uganda’s CBDC pilot in the $5.5 billion tokenised economy, Tinder for jobs, and Uganda’s CBDC pilot in the $5.5 billion tokenised economy.